A Climate Plan Engineered to Actually Pass Congress

Resolving the Carbon Pricing Trilemma

Robert G. Eccles and Timothy J. Youmans

October 22, 2025

Authors’ Note: This blog post is a summary of Bob and Tim’s new SSRN research paper: Resolving the Carbon Pricing Trilemma: A Research-Backed Framework for a Fiscally Sound, Politically Durable, and Climate-Effective U.S. Strategy.

Here is a link to a six-minute video summary of Resolving the Carbon Pricing Trilemma.

Bob and Tim are thankful for the significant contributions of a team of different, commercially available, frontier-class large language models. Under the authors’ strategic direction, this AI team undertook all of the foundational drafting, strategic enhancement, critical review, and final synthesis that resulted in a working paper published on SSRN, this blog post, and the video summary.

The Climate Leadership Council has published an “Economists’ Statement on Carbon Dividends” making the case for a carbon tax. It has been signed by 3,649 U.S. economists across the political spectrum and includes 28 Nobel Laureates, 15 Former Chairs of the Council on Economic Advisors, and four Former Chairs of the Federal Reserve. MIT’s EN-ROADS climate simulator demonstrates that carbon pricing reaching $50-100 per ton of CO₂ by 2030 and $200 per ton by 2050 represents one of the most powerful policy levers available, potentially reducing global temperature increase by 1.5-1.8°C if implemented globally.

Yet today the general consensus is that putting a meaningful price on carbon is a political impossibility We do not agree with this and would like to offer a policy framework that, if nothing else, will help to generate a public and robust discussion to achieve the goal of a U.S. carbon pricing policy.

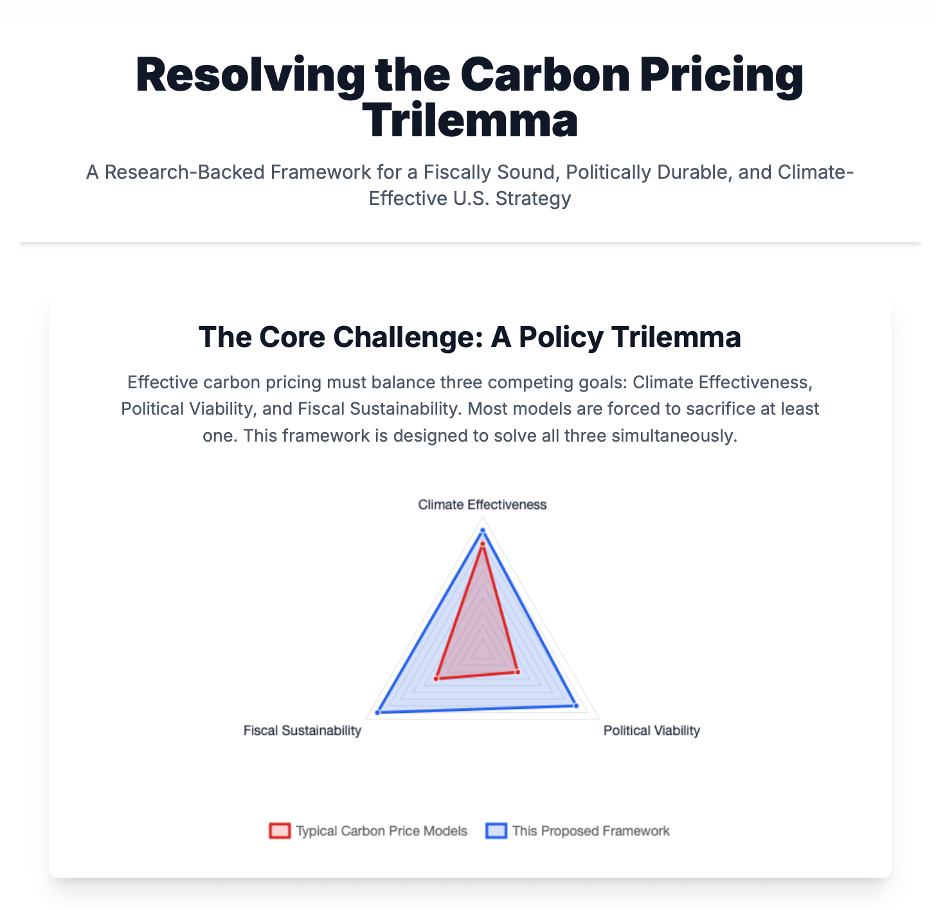

1. Introduction: Breaking the Climate Policy Gridlock

The United States confronts two reinforcing and existential challenges: runaway federal deficits that threaten long-term economic stability and mounting climate risks that impose escalating costs on the nation. These crises create a reinforcing negative feedback loop, where climate-related disasters worsen the deficit, and a constrained fiscal environment makes it politically impossible to act on climate. This history of gridlock highlights a core challenge that we call the “Carbon Pricing Trilemma”—the inherent tension between creating a policy that is effective for the climate, sustainable for the federal budget, and viable in our political reality.

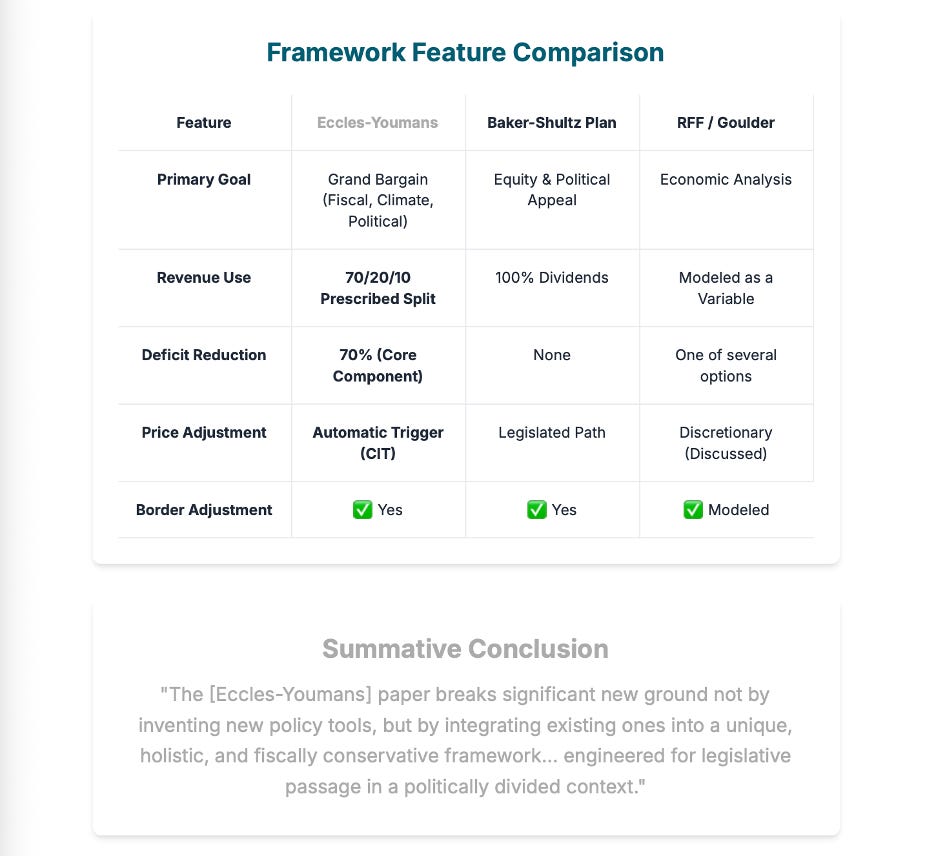

In a new research paper, we offer a different approach: a carbon pricing framework engineered from the ground up to solve this trilemma. The plan’s true innovation is not found in brand-new ideas, but in how it integrates proven policy tools into a cohesive structure built for a divided government. By focusing on political pragmatism and fiscal discipline, it presents a blueprint designed not just to work in theory, but to function as a “statutory fortress” engineered to actually become law.

2. Four Ideas from a New Climate Blueprint

Our framework moves beyond traditional debates by embedding its political strategy directly into its design. Here are four of its most important features:

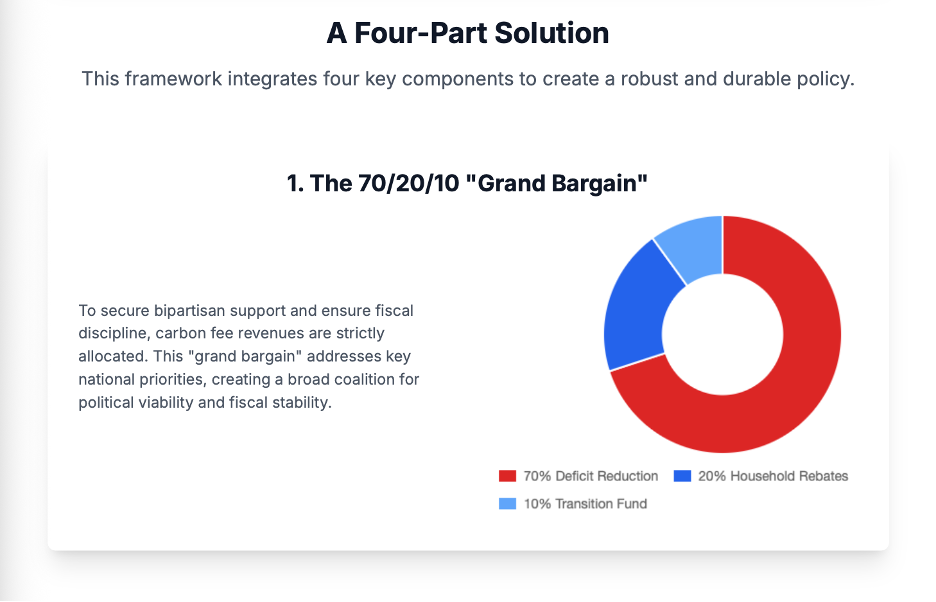

2.1. The “Grand Bargain”: Using 70% of the Revenue to Tame the National Debt

The plan’s most strategic feature is a strict 70/20/10 revenue allocation rule, designed as a “non-severable package.” All revenue is locked by statute into three streams:

● 70% for deficit reduction: A supermajority of funds is dedicated exclusively to servicing the national debt.

● 20% for household rebates: Funds are returned to low- and middle-income families to offset higher costs.

● 10% for a Transition & Competitiveness Fund: Targeted, temporary support is provided to key industries and communities.

This fixed allocation is the framework’s core political innovation. Its logic is analogous to the Base Realignment and Closure (BRAC) process, which succeeded by bundling difficult decisions into a single, up-or-down vote. By making the 70/20/10 split non-severable, the plan prevents factions from dismantling the compromise by fighting over revenue shares. The supermajority for deficit reduction is designed to attract fiscal conservatives—a group whose opposition has been “fatal to past climate proposals”—while the rebates ensure the policy is progressive. Analysis shows the average household in the lowest income quintile would receive a net financial benefit of +$420 per year.

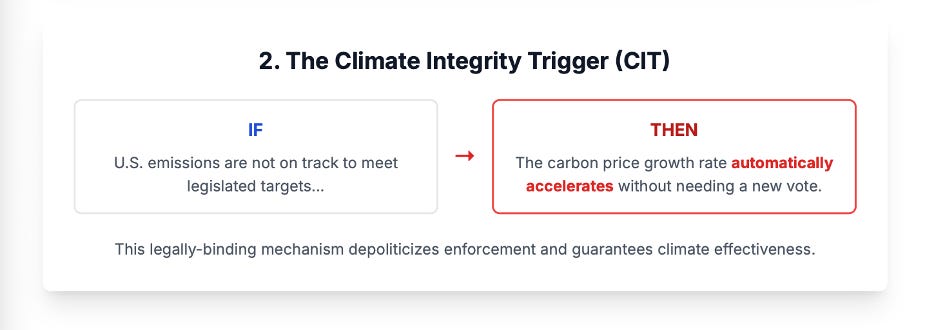

2.2. The Automatic “Fail-Safe”: A Trigger to Guarantee Climate Results

To ensure the policy delivers on its environmental promises, it includes a mechanism called the Climate Integrity Trigger (CIT). Its logic is simple and automatic:

● IF U.S. greenhouse gas emissions miss their legislated targets for two consecutive years...

● THEN the carbon price’s annual increase automatically doubles.

This trigger is “hard-coded into the statute itself,” activating without a new vote. Critically, the triggered acceleration is “statutorily authorized to push the carbon price above the upper bound of the standard ±30 percent price collar.” This establishes a clear hierarchy: in the face of underperformance, environmental integrity ultimately supersedes near-term price stability. It effectively “depoliticizes course corrections” and provides a credible guarantee that the framework will achieve its climate goals.

2.3. The Self-Destruct Switch: Designing Subsidies That Don’t Last Forever

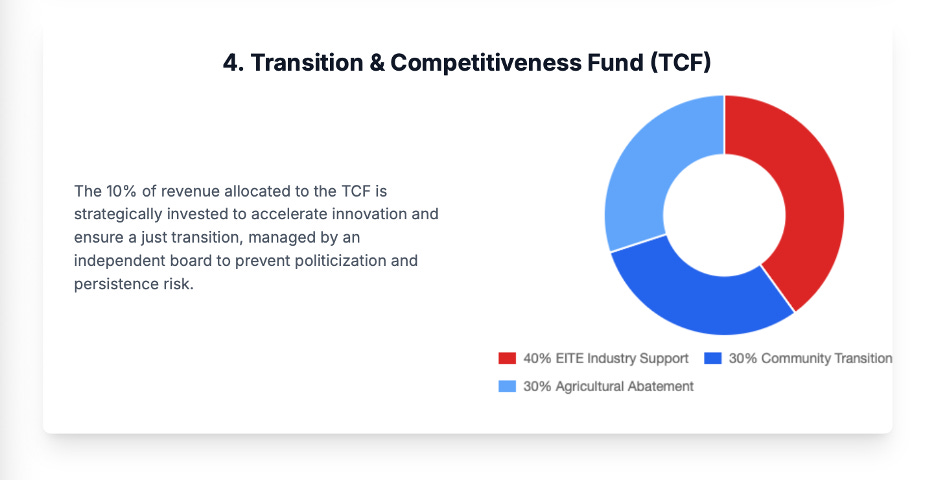

Government support programs often suffer from “persistence risk”—the tendency to become permanent political fixtures. The framework’s Transition & Competitiveness Fund avoids this trap with an innovative, performance-based sunset mechanism.

Instead of an expiration date that lobbyists can delay, funding for an industry like steel or cement is tied to technological progress. Support automatically phases out once its key decarbonization technologies are certified as mature, using the objective “Technology Readiness Level (TRL) 8” standard. This design fundamentally alters the political incentives for its beneficiaries, shifting them from lobbying for extensions to accelerating the innovation that makes them independent of the support.

2.4. The High-Stakes “Corporate Compact”: From Loopholes to Performance Contracts

The framework engages corporations through mechanisms that demand verified performance, not unconditional giveaways. Two key features illustrate this approach.

First, the Regulatory Reciprocity mechanism allows the carbon fee to replace less efficient regulations, but only on the condition that industry can prove—to a formal “Regulatory Equivalence Review Board (RERB)”—that it will achieve “equivalent or lower cumulative mass-based emissions.” This is a high-stakes contract. A crucial “snap-back” provision immediately reinstates the old rules if the sector fails to meet its performance targets.

Second, the plan includes a Performance-Based Safe Harbor from certain climate-related shareholder lawsuits. This is not a “get out of jail free card” but a “statutory affirmative defense,” analogous to the Business Judgment Rule in corporate law. A company can only earn this legal protection by adopting, disclosing, and verifiably implementing a credible, board-approved climate transition plan, certified by an independent third party.

3. Conclusion: A Blueprint for Reality?

By integrating a fiscal bargain, an automatic climate trigger, a smart sunset for subsidies, and a performance-based corporate compact, we feel our framework represents a uniquely pragmatic attempt to solve the Carbon Pricing Trilemma. Its design is a kind of “statutory fortress,” with its core functions embedded in law to be resilient to political and legal challenges. This approach acknowledges that in today’s environment, the technical elegance of a policy is less important than its ability to build and sustain a durable coalition.

Our proposed framework shifts the focus from ideological purity to functional and politically resilient design. This raises a critical question for the future of policymaking in a divided era. Could this kind of pragmatic engineering be the key to finally unlocking progress on our most intractable challenges?

We think our Resolving the Carbon Pricing Trilemma paper breaks significant new ground not by inventing new policy tools, but by integrating existing ones into a unique, holistic, and fiscally conservative framework, engineered for legislative passage in a politically divided context.

You can read the full, detailed research paper here: Resolving the Carbon Pricing Trilemma.